Annual Investment Allowance

The Finance Act 2021

The Finance Act 2019 temporarily increases the Annual Investment Allowance (AIA) from £200,000.00 to £1,000,000.00 for two years beginning 1 January 2019.[1] The Finance Act 2021 amends the 2019 Act to extend the allowance by an extra year.[2] The allowance will revert to its previous level of £200,000.00 from 1 January 2022.

The AIA is a capital allowance that enables a business to deduct the full value of an item against taxable income in the first year[3] and was introduced in the Capital Allowance Act 2001[4] (CAA 2001). Businesses generally make claims for capital allowances on plant and machinery. Plant and machinery are capital assets owned and used to produce income.[5] Examples include office equipment, computers, tools and manufacturing equipment.

Please note that ‘plant and machinery’ is not defined in CAA 2001. It is best to seek advice to confirm if your business can take advantage of the AIA.

The case of Yarmouth v France[6]establishes the principles of what plant is:

‘In its ordinary sense it (that is, plant) includes whatever apparatus is used by a businessman for carrying on his business – not his stock-in-trade which he buys or makes for sale; but all goods and chattels, fixed or movable, live or dead, which he keeps for permanent employment in the business.’

The UK Government website provides a non-exhaustive list of items that the AIA covers to further understand what is meant by plant and machinery. These range from the costs of demolishing plant and machinery to parts of a building considered integral.[7]

Integral features include, but are not limited to lifts, escalators and moving walkways, space and water heating systems, air-conditioning and air cooling systems, hot and cold water systems (but not toilet and kitchen facilities), electrical systems including lighting systems and external solar shading.

The AIA also covers fixtures such as fitted kitchens or bathroom suites, fire alarm and CCTB systems, and alterations to a building to install other plant and machinery.

Facebook Twitter Linkedin Instagram

What this means for your business

If you are looking to expand your business, now is the right time. The AIA is available to all types of business structures and not limited to just companies.

Take the following example:

A tech firm is looking to purchase a new commercial lease and plans to add fitted kitchens, bathroom suites, heating and cooling systems to the property. The firm also intends to upgrade its computer systems to keep up with the demands of the industry. To install these new upgrades, the firm will need to make alterations to the property.

The total cost of the qualifying equipment and integral features amounts to £500,000.00.

If the tech firm decides to proceed with the purchase and make improvements this year, £500,000.00 will be wholly deductible from the taxable amount.

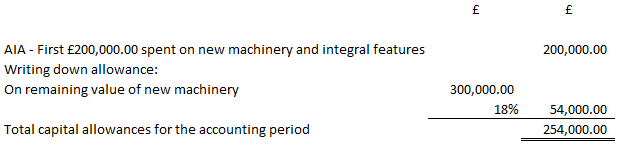

If the firm were to wait until 2022, only £254,000.00 would be deductible (Find calculation below).

What we can do for you

If you are looking to take out a loan to purchase a qualifying asset, we will be happy to advise you on the terms of the loan and the contents of the facility agreement.

If you require assistance in purchasing a new commercial lease, we have an experienced property team who can assist you in your property matter.

For anything further, feel free to get in touch by using the contact form to the left.

[1] S.32 Finance Act 2019.

[2] S.15 Finance Act 2021.

[3] Practical Law, Capital Allowance. Available at: https://uk.practicallaw.thomsonreuters.com/4-107-5846?transitionType=Default&contextData=(sc.Default)&firstPage=true [Accessed August 30, 2021].

[4] SS.51A to 51N Capital Allowance Act 2001.

[5] Cambridge Dictionary, Capital Asset. Available at: https://dictionary.cambridge.org/dictionary/english/capital-asset [Accessed August 30, 2021].

[6] (1887) 19 QBD 647.

[7] What You Can Claim On. Available at: https://www.gov.uk/capital-allowances/what-you-can-claim-on [Accessed August 30, 2021].

[8] Annual Investment Allowances. Available at: https://www.gov.uk/capital-allowances/annual-investment-allowance [Accessed August 30, 2021].